The EU starch industry’s plant-based protein products are key contributors to the EU Green Deal

March 2020

Because they provide concrete agronomic, environmental, climatic and nutritional solutions to today’s challenges, Starch Europe strongly believes that the production and processing of both cereals and plant protein crops into plant-based protein food and feed products should be made a priority at EU level.

The Commission’s forthcoming Farm to Fork strategy is the opportunity to take a broader and more consistent approach to bridge the gaps between the intentions of the EU Plant Protein Plan and its practical implementation into the existing regulatory framework and forthcoming research, investment and promotion policies.

Proteins as part of the European starch industry’s value chain

Every year, the EU starch industry processes about 24 million tonnes of principally EU-grown agricultural raw materials – mainly maize, wheat and starch potatoes and in smaller quantities peas, rice and barley – into about six hundred products ranging from native starches, modified starches, liquid and solid sweeteners to oils, proteins and fibres that are used as ingredients and functional supplements in food, feed and industrial applications.

Proteins are valuable components obtained from these raw materials, that significantly contribute to the competitiveness of the EU starch industry.

European starch industry’s diversity of plant-based protein product categories

Today, the EU starch industry provides proteins to customers on EU and global markets. The wide range of the EU starch industry’s protein products contain various protein levels ranging from 15% up to 90% to meet customer demand either in the feed sector or in the Business-to-Consumer food industry.

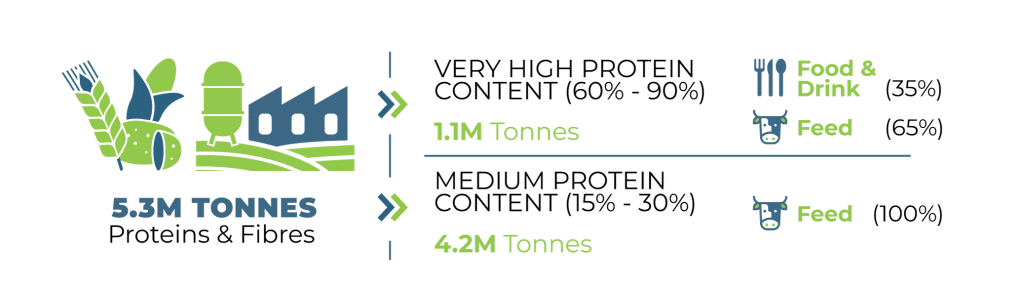

Of the 5.3 million tonnes of proteins and fibres produced by the European starch industry, 1.1 million tonnes are classified as very high protein content products - containing protein levels above 60% protein content. These include:

- Wheat proteins such as vital wheat gluten & its derivatives

- Maize proteins such as gluten meal

- Potato protein

- Pea protein

- Rice protein

The other 4.2 million tonnes are low-protein content products (such as corn gluten feed, wheat feed and dried distillers grains with solubles (DDGS) that are used in animal feed, and as such contribute to the production of milk, meat, eggs, fish and shrimps.

Innovation in today’s specialised feed and food applications

Every year, the EU starch industry invests about 80 million € in research and development across the board. Through targeted innovation, the EU starch industry has developed a broad portfolio of valuable plant-based protein ingredients with high-protein content. These plant-based protein ingredients provide both functionality and nutritional qualities in a wide array of food and specialised feed applications.

In the food market, innovative applications require a high level of protein content, particularly in bakery products, specialised nutrition or in the fast-growing sectors of meat or dairy alternatives.

In the bakery outlet, vital wheat gluten is a well-known example: it has the capacity to form a continuous extensible and airtight elastic network in doughs, a property referred to as visco-elasticity. This improves dough strength, softness and shelf-life of many bakery products.

Innovation also spreads across specialised nutrition, an area where the customers of the EU starch industry increasingly use the innovative functionalities and nutritional qualities of plant-based protein ingredients in, e.g.:

- sports nutrition

- slimming diets

- special diets for use in hospitals

- treating sarcopenia, particularly for the elderly population.

The specialised feed markets also require products with a higher content of proteins. For instance, corn gluten meal – the maize protein – is used in poultry, where the presence of xanthophylls contributes to the yellow colour in egg yolks. Vital wheat gluten – the wheat protein – is used in specialised feed applications such as starter formulations for young animals, or as replacement of fish meal in aquaculture. Pet food also is an important outlet for the EU starch industry’s plant-based protein products.

The lower-protein products are used to feed farmed insects, and to complement feed for poultry, pigs or cattle.

Increasing EU consumer demand

As highlighted in the Commission’s EU Plant Protein Plan and the study on “Market developments and policy evaluation aspects of the plant protein sector in the EU”, plant-based proteins are increasingly used in food.

Plant-based protein ingredients are a useful and flexible alternative for consumers who want to decrease their meat consumption or follow a vegetarian diet, as they need to find a diversified source of proteins. To meet the increasing demand, our proteins are used as a valuable ingredient in flexitarian, vegetarian and vegan diets:

- From replacement of animal proteins in products like burgers and other meat or dairy alternatives, to examples where the plant-based proteins are used as functional ingredients or as texturizers in vegan products

- potato protein as emulsifier in:

- dressings and sauces (e.g. non-allergenic vegan mayonnaise)

- vegan, Halal and Kosher confectionary, as replacement of animal-based gelatine protein

- pea protein isolates in

- wet extrudates, dry products (e.g. snacks or Texturized Vegetable Proteins)

- instant drinks (e.g. fortified with these proteins, meeting consumers’ demand for low-sodium healthier products)

- wheat protein providing texturizing properties and complementary nutritional value for total or partial replacement of animal proteins in human nutrition.

Beyond competition towards full complementarity

All outlets are important to the EU starch industry, as they significantly contribute to its overall competitiveness on the EU and global markets.

In the mature feed market, corn gluten feed and wheat feed contribute to increasing the EU availability of plant-based proteins, making the EU more self-sufficient.

In its continuous research effort to valorise the whole plant, the EU starch industry has developed the markets for animal feed over the years, including traceable and certified feed chains. One third of the EU starch industry’s protein -the less concentrated part- go to feed outlets as those products are not digestible by humans. The starch industry will continue to serve the ruminants and pigs markets with mixtures of proteins and fibres.

The more starch the EU industry produces, the more protein and bran-rich fibres it extracts, providing high-quality feed and helping to compensate for the EU’s structural deficit in plant-based proteins.

There is therefore no competition between the food and feed markets for plant proteins.

Diversity of tomorrow’s new protein sources

In the medium-term, new protein sources will likely use feedstock from the EU starch industry to produce alternative proteins. For instance:

- starch-based products – such as glucose and carbohydrates - used as a carbon source to produce protein-rich micro-organisms or micro-algae

- bran and spent water to produce insect proteins

- Corn Steep Liquor that can serve as nitrogen source to produce protein rich micro-organisms or micro-algae.

The three axes of Starch Europe’s recommendations:

1. Production and processing in the EU plant protein supply chain

Together with our customers, we strive to offer convenience & diversity in plant-based food and drink products.

To date, the EU Plant Protein Plan and most Member States’ plans focus on the growing of the protein crops themselves and overlook the processing steps and circular economy principles of starch biorefineries. We therefore call on the Commission to take a farm-to-fork approach and integrate the value of the first processing of cereals and plant protein crops into plant-based protein food and drink products. This will help address the consumers’ request for local sustainable products as well as more convenience & diversified plant-based protein products.

Plant-based food and drink products have great market potential, for farmers & cooperatives, as well as for the processing industries. That is substantiated by:

- The commission’s EU Plant Protein Plan’s own assessment identified the food segment as a small market with promising prospects: e.g. dairy and meat alternatives grow by 11% and 14% annually: EU-grown plant proteins are in high demand from the food industry.

- From an innovation perspective, the study commissioned by EUVEPRO in 2018 shows a huge increase in New Product Launches (NPLs) containing plant proteins in the period from 2007 to 2017. The average annual growth in vegetable protein NPLs over this 10-year period is 13.5%. This dynamic market is increasingly attracting diversified sources of plant proteins such as rice protein and potato protein, in addition to the more traditional proteins: wheat, soy and pea.

- The development of pea and potato protein products offer EU farmers new and promising opportunities, bringing high profit margins for farmers in the context of a decreasing CAP budget.

- The introduction of leguminous plants with high protein content and which can be processed in starch plants in crop-rotation allows natural soil fertilization.

2. Research and Innovation

The starch industry is investing in its protein potential to introduce new crops, to valorise even more the protein fraction contained in the grains, the peas and the starch potatoes and to sell them to the food and feed markets, which will increase the added-value of the whole starch supply chain.

With this objective in mind, Starch Europe calls on the Commission to support the development of a sustainable and competitive EU supply chain for all existing plant-based proteins and potential new sources of proteins for use in food and feed through:

- supporting the innovation at each level of the plant-based value chain, through research and innovation funding in e.g.:

- improving seeds to achieve better and more stable yields and greater disease resistance in protein crops

- optimising first transformation processes of agricultural raw materials to produce ingredients for food, feed and industrial applications

- improving the know-how on the functionality, quality and consistency of plant-based protein products in food applications

- assessing the nutritional quality and impact of new protein sources alone or in combination with animal proteins.

- integrating plant-based proteins as food ingredients into the future Horizon Europe programmes, such as FOOD2030 “An agenda for a climate-smart and sustainable food system for a healthy Europe” that recommends “switching to more plant-based proteins has a large potential to reduce the environmental impact of the food consumption”.

- making sure the supply chains of plant-based protein products are in the scope of the Strategic Research and Innovation Agenda 2030 (SIRA) of the Bio-industries consortium, who is the private partner of the Bio-based Industries Joint Undertaking (BBI JU).

- Starch Europe is currently inputting into the BIC’s SIRA to make sure that the successor to the current Public Private Partnership BBI JU, temporarily called the Circular Bio-based Europe, covers projects that will build on existing or create new value chains producing innovative plant-based protein ingredients for the food and drinks applications.

- Also interesting in this field is supportive research in the agronomical and nutritional aspects of plant-based protein products.

3. Promotion and awareness-raising

In its “Recipe for change: An agenda for a climate-smart and sustainable food system for a healthy Europe”, the Commission’s Food2030 Independent expert group recommends increasing the intake of plant-based proteins in the human diet. Recommendations in this objective include:

- co-funding to improve consumer perception of plant proteins properties through education & promotional campaign on the EU single market.

- EU or national informational campaigns to raise awareness on the benefits of producing and consuming plant protein products in food and drinks. This will require to resolve the current regulatory vacuum of promotional measures under Regulation 1144/2014 :

- We particularly welcomed recommendation number 4 of the EU Plant Protein Plan, which states to: “Promote the benefits of plant protein for nutrition, health, climate and environment, Member States and stakeholders are invited to use the various possibilities to proactively communicate and promote protein plants for agriculture, feed and food. One option is to use upcoming calls under the EU promotion programme for agri-food products (...). In 2019, EUR 200 million will be available to co-finance promotion programmes”.

- Since the announcement of the EU Plant Protein Plan in Vienna in 2018, EU policy for promoting plant-based protein products has proved more challenging than expected. We call on the Commission to take the opportunity of the impact assessment and potential revision to envisage extending the list of eligible products to plant-based protein products. Including CN codes 2106 10 and 21 06 90 (“Food preparations not elsewhere specified”) in Annex I of Regulation 1144/2014 would cover plant-based food and drink products and respond to increasing customer demand and EU sustainability goals.

- We also call on the Commission to promote, in a proactive manner, an increase in the consumption of plant proteins in the human diet in order to meet the inevitable increased need for proteins across-the-board from the growing global population.

Conclusion: the EU starch industry’s plant protein products have many assets to feature highly in the Farm to Fork strategy

Plant protein products are identified as enablers to fight climate change and to move towards more sustainable, healthier diets.

As their innovative and promising potential will contribute to the implementation of the EU Green Deal, they should have a prominent role in the Farm to Fork strategy, advocating for an increase in the consumption of plant proteins in the human diet over time – taking a value chain approach.